Volatility interruptions are safeguards with the aim of preventing sudden price changes and protecting against incorrect order entries. These safeguards can be triggered in the continuous and in the auction trading method.

- What Conditions Trigger a Volatility Interruption?

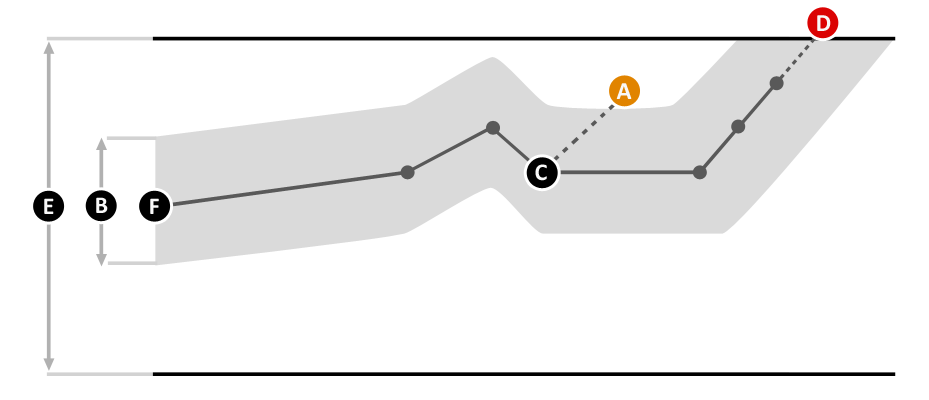

- At the order entry that would lead to a trade execution A at a price that would exceed a predefined dynamic price corridor B. A reference price of the dynamic price corridor is the last trade price C.

- At the order entry that would lead to a trade execution D at a price that would exceed a predefined static price corridor E. A reference price of the static price corridor is the last auction price F (determined in an opening auction, volatility interruption, an extended volatility interruption or in a closing auction). If no transactions have been concluded within the auction on a certain trading day, the most recent price determined on one of the previous trading days is used instead.

| Symbol | ISIN | Category | Dynamic Corridor | Static Corridor | Extended Volatility | Static Ref. Price | Dynamic Ref. Price | Min Price | Max Price |

|---|

- Symbol

- Dynamic Corridor

- Static Corridor

Category

- 0

- No Trading Limits

- X

- Trading Limits Exception